Truebit Smart Contract Exploit Drains $26M in DeFi Attack

How the truebit Smart Contract Exploit Drained 8,535 ETH

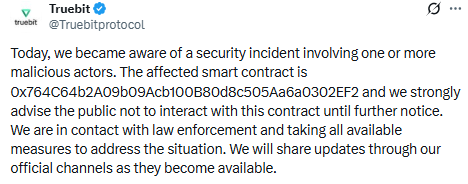

A major security incident has shaken the DeFi space after Truebit confirmed that one of its smart contracts was exploited by malicious actors. The attack led to the loss of nearly 8,535 ETH, valued between $26.4 million and $26.6 million, making it one of the first large DeFi exploits of 2026.

Truebit shared the warning through its official X account, asking users to avoid interacting with the affected contract until further notice. The team also confirmed that law enforcement has been informed and an investigation is ongoing.

Source: X Account

What Happened in the Exploit

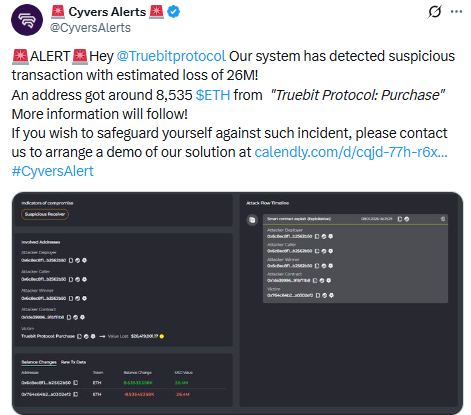

Blockchain security firms were the first to spot unusual activity. Cyvers, along with PeckShield, CertiK, and SlowMist, flagged large and abnormal transactions tied to the Truebit contract.

Investigators found that the attacker exploited a pricing logic bug in the contract’s minting function. This flaw allowed massive amounts of TRU tokens to be minted or purchased at almost zero cost. The attacker then dumped these tokens on the market, draining liquidity rapidly.

Scale of the Losses

The exploit caused severe damage in a very short time:

Total ETH drained- 8,535 ETH

Estimated value lost- $26.4–26.6 million

Primary attacker profit- $26 million

Secondary attacker profit- $250,000

For many users, this was not just a technical issue. It was a sudden and painful loss of savings.

Source: Official X Account

TRU Token Price Collapse

The market reaction was brutal. The TRU token price crashed over 99.9%, falling from around $0.16 to as low as $0.0000000029. Liquidity vanished almost instantly.

Long-term holders reported devastating losses. Community channels were filled with shock, anger, and fear. Some people said years of holding were wiped out in minutes. Others questioned how an old contract could still hold such a critical flaw.

Why This Exploit Matters

This incident highlights a harsh truth about DeFi. Even audited or long-unused contracts can still hide dangerous bugs. Legacy code, when left unmaintained, can become an easy target for attackers who know where to look.

For users, this exploit is a reminder that smart contracts are not risk-free. Trust should always be paired with caution.

What Truebit Has Said So Far

It has confirmed:

The exploit involved a malicious smart contract interaction

Users should not interact with the flagged contract

Authorities are involved

Updates will be shared only through official channels

So far, no recovery plan or detailed post-mortem has been released. Users are waiting for clarity on whether any funds can be recovered.

User Perspective: What This Means for You

If you are a DeFi user, this event matters even if you never held TRU.

Key takeaways for users:

Avoid interacting with contracts flagged by project teams

Follow updates only from official sources

Do not rush to “buy the dip” after major exploits

Spread funds across wallets and protocols

Many users affected by this exploit trusted that inactive contracts were safe. This attack shows that silence does not mean safety.

A Warning for the DeFi Industry

The Truebit exploit stands as one of the first major DeFi security failures of 2026. It sets a serious tone for the year ahead and raises concerns about old contracts still holding value without active maintenance.

As investigations continue, users are advised to stay alert and cautious. In DeFi, security is not just a feature it is a daily responsibility.

This story is still developing. Users should avoid the affected contract and wait for official updates before taking any action.

FAQs

1. What happened in the Truebit smart contract exploit?

Attackers used a bug in the smart contract to mint TRU tokens at very low cost and drain 8,535 ETH.

2. How much money was lost in the Truebit exploit?

Around 8,535 ETH was drained, valued between $26.4 million and $26.6 million.

3. Why did the TRU token price crash?

The attacker dumped large amounts of TRU tokens, which caused liquidity to disappear and prices to collapse.

4. What has Truebit advised users to do?

Truebit warned users to avoid interacting with the affected smart contract and follow official updates only.

5. Are funds being recovered from the exploit?

So far, no recovery plan or post-mortem report has been shared, and the investigation is still ongoing.